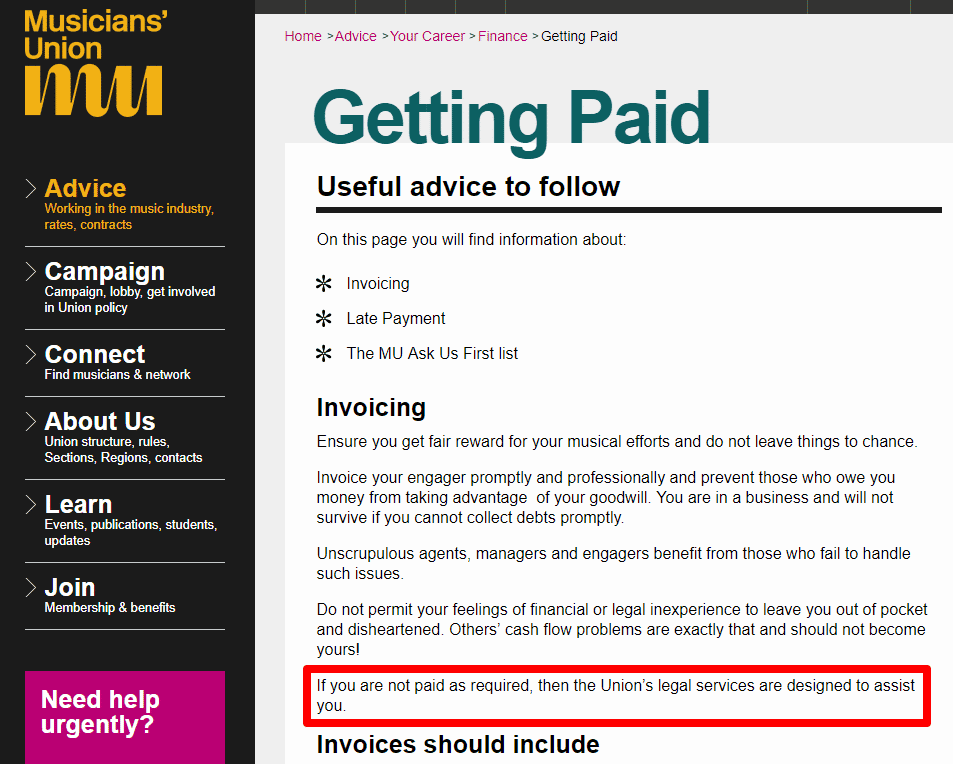

Legal action of any kind can be expensive, and if the thought of handling a Small Claims Court petition concerns you, it might be pertinent to ensure you are insured.

How can insurance help to reduce legal costs? Ask yourself if taking legal action is worthwhile and if the size of the debt justifies this course of action before you commence.

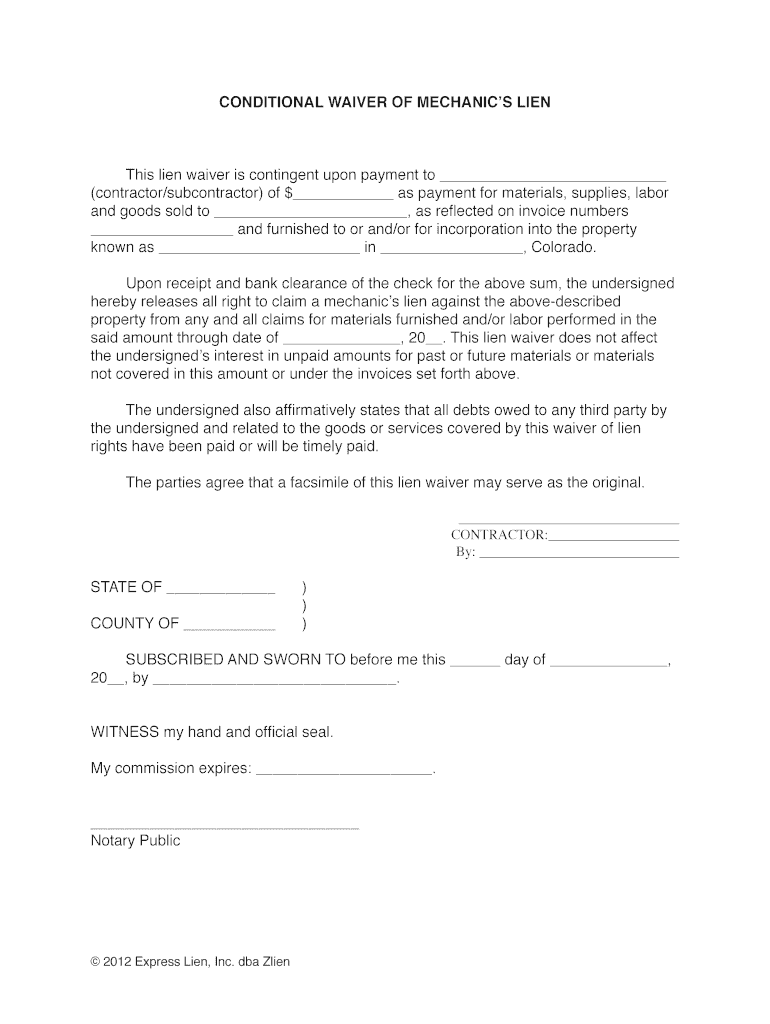

Taking legal action of any kind can be expensive and, in many cases, it is seen as the last resort. If you’ve been compelled to charge late payment interest on your invoices, but have still not received payment, then you could consider further action.

You can only charge a business once for each payment, as follows: The amount you can charge depends on the size of the debt owed to you. You are also entitled to charge a business a fixed sum for the cost of recovering a late commercial payment on top of claiming interest for it. Divide £85 by 365 to work out the daily interest: 23p per day (£85 / 365 = £0.23).Also, you can’t use a lower interest rate if you have a contract with public authorities (1).Īs an example, if your business is owed £1,000 and the Bank of England base rate is 0.5%: Note: you can’t claim interest if there is a different rate of interest within a contract. If you opt to add interest to the money you are owed, you will need to send a new invoice to your client.

#STATUTORY INTEREST ON UNPAID INVOICES PLUS#

Statutory Interest is currently set at 8% plus the Bank of England base rate for business-to-business (B2B) transactions. The interest you can charge if another business is late paying for goods or services is called “statutory interest”. You can charge interest and claim debt recovery costs if another business is late paying for your goods or services. What interest can you charge clients for late payments? Set out your terms in a written document that your client must sign and date, so you have reference to call upon in the future. It is important to ensure your clients are aware of this, so they are not unpleasantly surprised when they see it in writing for the first time. One point you need to clarify is that you charge interest on late payments. The best way to ensure you are paid on time is to clearly explain your terms and expectations from the outset and agree them with your client.

How you can help to ensure you are paid on time

0 kommentar(er)

0 kommentar(er)